Key Takeaways: Decentralized Autonomous Organizations Explained

- A DAO, or decentralized autonomous organization, is an online group that governs itself using automatic contracts.

- DAOs are often formed to raise and disburse pools of cryptocurrency.

- Voting power in a DAO normally comes from holding its token, but some are experimenting with other verification methods. DAO voters can gain outsized power by hoarding tokens.

- Since a DAO’s governing code exists openly on the blockchain and can’t be changed, hackers are able to exploit zero-day vulnerabilities.

As cryptocurrency evangelists will tell you, the ultimate promise of cryptocurrencies such as Bitcoin is a financial system with no masters — money that runs itself and is trusted equally by all its users. The decentralized autonomous organization (DAO) is a cornerstone of this future. In this article, we’ll answer the question “what is a DAO crypto?” and explore its implications.

An ideal DAO runs itself entirely on smart contracts, which are algorithms that automatically execute themselves under certain conditions. DAOs use blockchain technology to establish trust by making all decisions perfectly visible. Any non-hierarchical organization managed by algorithm can be a DAO, though their purpose is usually to manage money.

Enthusiasts have founded DAOs for missions that range from managing crypto assets to buying land in Wyoming to purchasing an original copy of the U.S. Constitution. Of course, as with anything in cryptocurrency, there’s a gap between the dream and the execution.

We’ll cover all you need to know about DAOs in the sections below. If you’re still not sure about cryptocurrency, our crypto for dummies guide can help you get started.

What Is a DAO in Crypto Lingo?

A DAO (usually pronounced “dow”) is a decentralized autonomous organization that’s governed by blockchain smart contracts instead of a centralized leadership hierarchy. Its purpose is most often to manage a treasury, a large pool of crypto or fiat currency.

— there’s no one place you can find it.

DAOs could technically exist without the internet. All you need is a group of people with a shared purpose, no leadership and a set of rules they’ve all agreed to follow. However, thanks to the internet, DAOs can not only unite like-minded folks from all over the world, but also create smart contracts to automatically execute shared rules.

The first DAO, just called “The DAO,” was a decentralized version of crowdfunding that let all contributors vote on how to spend the money raised. This twist made The DAO wildly successful, managing around $150 million in Ether at its peak. When a hack devastated The DAO’s finances in 2016, developers forked the Ethereum blockchain to reverse the damage.

Despite the mixed outcome, other DAOs soon followed The DAO’s lead. The concept of an organization without central control, with no authorities to take advantage of their power, proved inherently exciting to cryptocurrency and Web 3.0 adherents. In theory, a DAO can do anything a traditional organization can, though they’ve largely been used to manage money so far.

Some notable examples are currently active. FreeRossDAO, which funds a campaign to release imprisoned Silk Road founder Ross Ulbricht, operates like a nonprofit charity. ConstitutionDAO, mentioned above, was formed solely to make the winning bid at an auction (though it lost in the end).

How Does a Decentralized Autonomous Organization Work?

To review, a DAO is decentralized (has no central authority), autonomous (manages itself without human input) and an organization (a group of people acting as a single unit to achieve a common purpose). With that in mind, let’s explore the technologies and processes that make this concept viable.

Where a normal organization has bylaws and penalties for not following them, a DAO encodes all its rules via smart contract. These contracts, which are publicly visible on the DAO’s blockchain, can both govern procedures and prevent abuse. They apply equally to everyone, with no gulf between those making decisions and those subject to them.

The character of a DAO is largely shaped by its smart contracts and the code behind them. It can help to think of a DAO as a wind-up toy. Its creators build the system out of smart contracts on a blockchain (usually Ethereum), then let it go. After that, the DAO should be able to run itself indefinitely without further input from the developers.

the governing body of one of the biggest metaverse platforms.

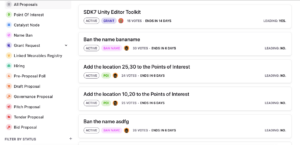

To involve everybody in decisions, community members freely submit proposals and vote on all actions. Smart contracts process the votes and automatically take actions that win majority votes. For example, if a venture capital DAO wants to decide whether to invest funds, its members will vote. If “yes” wins the vote, a smart contract automatically transfers the money.

Governance Tokens and DAO Voting Privileges

Being built on blockchain technology makes DAOs more transparent and less hierarchical, but they’re still not perfect democracies. Membership and voting privileges are most often conferred by staking the DAO’s governance token, an on-chain asset that contains its smart contracts. The more of the native token you own, the more votes you get.

The logic is that since the value of the token is tied to the performance of the DAO, people who own more of it will be more invested in making good decisions. A voter who owns 1% of a DAO’s tokens can vote in bad faith without hurting themselves, but a voter with 50% needs to vote intelligently lest they tank their own position.

It’s a lot like owning shares in a traditional corporation — and comes with similar problems. More tokens equals more responsibility, but also more power. As we’ll cover in “Limitations of DAOs” below, consolidating rights in the hands of majority owners risks the exact kind of centralization DAOs were formed to avoid.

The actual votes tend to occur on Discord servers connected to the DAO. When a member makes a proposal, bots announce a vote on Discord and all certified members participate. A certain quorum is usually necessary for voting.

Other DAO Voting Systems

The token-based method is the most common way to verify a DAO’s membership, but there are other approaches. Share-based DAOs require an application to ensure every new member provides value, whether by holding tokens, contributing work or bringing expertise to the table. Reputation-based DAOs confer voting power through participation instead of ownership.

Problems With DAOs

DAOs are still in their infancy as both a technology and a philosophy and have a lot of obstacles to overcome on the path to mainstream adoption. As DAOs are a new kind of entity, most governments have yet to agree on their legal status, which restricts the decisions they can make without liability. Here are some other kinks that still need working out.

Unequal Voting Rights

We’ve already mentioned a scenario where a few people buy up large percentages of a DAO’s governance token to consolidate power. That’s not just theoretical: Research by Barbereau et al. in 2023 shows that it’s the most likely outcome.

The researchers chose nine Ethereum-traded tokens that conferred voting privileges in a DAO and followed them for four years. They discovered that no matter how well token ownership was distributed at the moment of founding, all nine tokens eventually concentrated in the hands of a few high-volume investors.

unto themselves, making and passing their own proposals.

The study concludes that a completely decentralized system with no oversight of trade is paradoxically more likely to create inequality. Large holders sit on their tokens instead of trading them. As a result, the researchers found that less than 1% of token holders actually voted on DAO decisions during the four-year period.

Hostile Takeovers

The risks of concentrated ownership came into sharp relief when a DAO called Build Finance suffered a coup in 2022. The anonymous attacker, who had accumulated a large hoard of Build Finance DAO’s BUILD tokens, submitted a proposal to give themselves unrestricted power to mint more tokens.

The proposal predictably failed, but the attacker submitted it again — this time after disabling the bots that announced new votes on the Build Finance DAO Discord server. Now the sole party voting, the attacker won the second round, then proceeded to loot the entire treasury and disappear into the night.

The worst part about the Build Finance DAO coup is that it technically wasn’t hostile: All the attacker did was follow the rules. It’s a clear sign of the need for better voting approaches if DAOs continue being founded.

Security Risks

The first successful DAO — the one known as “The DAO” — still exists, but its token has been widely delisted. The proximal cause of its collapse was a massive hack that stole about a third of The DAO’s total treasury. The money was recovered by a hard fork of Ethereum (basically reloading the blockchain from a previous save), but The DAO’s reputation never healed.

The hack reveals a deeper problem with both The DAO and DAOs in general. The creators of The DAO knew about the security flaws before the theft but were powerless to change its code. Since nothing on the blockchain can be altered after uploading, fixing the holes would have required the creation of a new DAO, with a long voting process.

The lack of anonymity is a known issue with blockchain, but the bigger problem is that DAOs cannot nimbly respond to changing conditions. Once the vulnerabilities were published, The DAO could do nothing but wait for the hack.

Final Thoughts: How DAOs Work

DAOs arose as a response to a problem of traditional hierarchies: The more power one person has, the easier it is to misuse that power. The developers of The DAO and its successors envisioned a world of truly democratic organizations that could not fail to represent the interests of all their members.

However, solving the problems of centralization without creating new ones has proven challenging. Needing to vote on every decision, DAOs have trouble responding to fast-moving threats. The total transparency enforced by the blockchain is a serious security danger. Worst of all, the very rules of a DAO can open the door to power grabs and coups.

That’s not to say there’s no future in the DAO model. Alternate share-based and reputation-based voting systems offer hope for preventing future coups, and solutions may yet be found for the security flaws. In the end, just like cryptocurrency itself, DAOs are down but certainly not out.

Have you ever been part of a DAO? Are you still a member? If not, why did you leave? Share your story and opinions in the comments, and thanks for reading!

FAQ: DAOs Explained

-

A DAO manages a large pool of money by polling all approved members about every decision. To vote, you almost always need to hold a certain amount of the DAO’s related token.

-

The best-known is The DAO, which granted money to various crypto projects before losing much of its treasury in a hack. Another illustrative example is ConstitutionDAO, which raised money to buy an original copy of the U.S. Constitution at auction.

-

No, Ethereum is a protocol that lets computers share and execute smart contracts. However, smart contracts are the core technology that makes DAOs possible, and most DAOs are hosted on the Ethereum blockchain.

The post What Is a DAO in Crypto: Decentralized Autonomous Organizations Explained appeared first on Cloudwards.