Key Takeaways: Best Crypto Exchange Compared

- There’s no such thing as a perfectly safe crypto exchange, so your selection should be based on acceptable risk.

- Crypto.com has the best balance of products, low fees and safety from regulation. Coinbase and Binance would likely be in the lead if it weren’t for the SEC’s 2023 lawsuit.

- Kraken and Gemini are safer options, though they charge higher fees and offer fewer products.

It’s technically possible to trade cryptocurrency without going through a centralized exchange (CEX), but cryptocurrency exchange platforms remain, by far, the best way for everyday buyers to invest. They have the most users, the most liquidity and a friendly experience. In this article, we’ll compare platforms to help you identify the best crypto exchange for your needs.

Centralized exchanges are odd chimeras of financial services — imagine a bank, a stockbroker and PayPal rolled into one. They can be difficult to judge on their own merits with so many moving parts. To us, the most important factor is trust, and that’s what we emphasized when compiling this list.

If you live in the United States, many of the best crypto exchanges are either completely unavailable or offer limited features due to local regulations. We’ll show you which ones you can still use as an American. We’ll also discuss ease of use and additional features like staking, plus the litigation history of our top choices.

Before we start, here is our usual warning: Nothing in this article should be taken as financial advice. Trading cryptocurrency is risky at the best of times due to the likelihood of dramatic price fluctuations. Things are even more volatile in the wake of the FTX collapse and the SEC’s crypto lawsuit against Coinbase and Binance. You can learn more about the risks in our crypto for dummies article.

What Makes the Best Crypto Exchange

When choosing between global crypto exchanges, the most important factor is reliability. Look for crypto exchanges that have never been hacked and honor withdrawal requests. Some platforms on our list are currently on shaky ground, but still offer you a good chance of getting your money back in a worst-case scenario.

- Crypto.com — Accessible mobile-only crypto exchange

- Coinbase — An excellent service in the short term

- Binance — High-liquidity platform with staking options

- Gemini — Secure, friendly exchange for retail investors

- Kraken — A safer choice despite some troubling behavior

With the SEC tightening regulations on leaders like Coinbase and Binance, reliability can be hard to come by. Trading crypto today is often a matter of balancing short-term benefits with long-term risks. Coinbase, for example, is a great entry-level trading platform, but it may cease to exist in its current form within the next few years.

In addition to stability, look for centralized exchanges with low exchange fees, especially for your intended trading volume (lower volumes usually pay a higher percentage in crypto exchange fees). You’ll also want ones that trade the coins you’re interested in. Every exchange trades popular assets like Bitcoin, but a wider selection gives you a better chance to buy into the next big thing.

We’ve also looked for special features and unique ways to earn money on each exchange. There should be a basic interface for new investors and a well-designed spot trading section for experienced traders that need advanced tools.

The 5 Best Crypto Exchanges

Keep in mind that with crypto on a downswing, we can’t recommend any exchange with total confidence. Even the best platforms will never be as safe as a traditional bank, and you may lose your money in the event of a bank run or punishing litigation.

Also, remember that due to the fundamentals of blockchain, crypto is never anonymous. With all that in mind, here are the five best CEX options right now.

1. Crypto.com

but it’s the safest place to park your crypto right now.

More details about Crypto.com:

- Pricing: 0.075% maker and taker fees when trading less than $250,000

- Provider website: crypto.com

Pros:

- Transparent fee structure

- Good regulatory standing

- Offers 250 currencies

Cons:

- Only exists as a mobile app

- Difficult sign-up process

- Suffered serious hack in 2022

Crypto.com may be best known for an expensive 2023 Super Bowl ad starring Matt Damon, but there’s more to it than just good marketing. For a novice investor, this exchange offers the best available balance between user-friendliness and breadth of options. Along with about 250 different crypto assets, it offers a debit card, so you can spend your coins in the real world.

Crypto.com is currently a mobile-only interface, which can be inconvenient, especially for serious traders. The app can also be glitchy, with slowdowns likely in some parts, but it provides plenty of information and organizes it intelligently. Your wallet and all important functions, including buying, selling and fiat deposit, are easy to read and use. Our full Crypto.com review has the details.

A Legally Stable Crypto Exchange

Having said all that, there’s one huge reason we’ve listed Crypto.com at the top, and it’s got more to do with other exchanges than this one: Crypto.com is our favorite CEX that hasn’t been sued. The Crypto.com website bills it as the “leader in regulatory compliance,” and it actually has some claim to that title — the SEC left it out of the lawsuit that targeted Coinbase and Binance.

To be clear, this doesn’t mean Crypto.com is completely safe; just that it’s currently the least likely exchange to be shut down by regulators. It has other issues, particularly a security flaw that led to $34 million in “unauthorized withdrawals” by hackers in January 2022. All funds were replaced by the company once the flaw was fixed, and there hasn’t been a serious hack or penalty since then.

but it’s got other issues.

Crypto.com has relatively low trading fees, and the whole structure is easy to understand. The duty on each trade is assessed by your trading volume for the prior 30 days. If you traded less than $250,000 in aggregate, you’ll pay 0.075% on each transaction. Maker and taker fees only diverge above $250,000, so if you’re a low-volume investor, feel free to make immediate orders.

| 30-day trading volume | Maker fee | Taker fee |

|---|---|---|

| Less than $250,000 | 0.075% | 0.075% |

| $250,000 to $1M | 0.070% | 0.072% |

| $1M to $5M | 0.065% | 0.069% |

| $5M to $10M | 0.060% | 0.065% |

| Greater than $10M | 0% | 0.05% |

2. Coinbase

keep an eye on the news and have an exit strategy.

More details about Coinbase:

- Pricing: Fee schedule not publicly available

- Provider website: coinbase.com

Pros:

- Easy to access & use

- Publicly traded for better visibility

- Staking in the United States

Cons:

- Currently facing SEC litigation

- No transparency in trading fees

- Has suffered hacks

Until 2023, Coinbase would have been a shoo-in for the top spot. It was the first crypto exchange to make an IPO, making it accountable to shareholders and theoretically more transparent. It also made a point of reporting customer profits to the IRS to ensure users paid their taxes. It’s usable in the United States and even offers staking (though not in every state).

However, the 2023 SEC lawsuit has put Coinbase in an odd place. The lawsuit could drag on for years, and Coinbase has vowed to continue business as usual until there’s a ruling. Until then, it’s one of the friendliest exchanges to buy and sell crypto, but don’t put a single cent in without a plan to absorb the risk. See our Coinbase review to learn more.

The Easiest Crypto Interface

Coinbase is friendly enough for new investors that we’re prepared to recommend it even while its future is in doubt. Signing up for a crypto exchange account is fast even with verification, it accepts a wide range of payment methods, wallets are clearly readable and everything is available on both desktop and mobile.

Coinbase is not forthcoming with its trading fees or most of its other pricing. You can, however, tell a few things from the website, such as that credit transactions cost 2% and that staking and using a Coinbase debit card are both free. For trading fees, however, all we get is that they “may be determined by a combination of factors.”

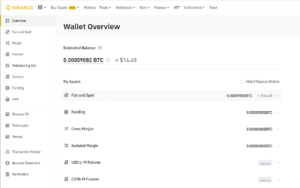

3. Binance

but they can still use the stablecoin BUSD.

More details about Binance:

- Pricing: 0.1% maker and taker fees when trading less than $1,000,000 and holding a Binance coin (BNB) balance of under 25

- Provider website: binance.com, binance.us

Pros:

- Most available coins

- Plenty of trading pairs

- High liquidity

- Lots of products

- Staking in the U.S.

Cons:

- Target of SEC lawsuit

- Separate platforms for U.S. & rest of the world

- Better trading tiers require BNB

Binance is the other defendant in the SEC’s major 2023 crypto lawsuit, and we recommend it with the same caveats. It’s a welcoming platform with a lot of liquidity to facilitate crypto trades, and it comes with more passive income options than almost any competitor. However, depending on the results of the suit, it may not be a safe place for your crypto in the long term.

Like Coinbase, Binance was named in the lawsuit in part because of its high profile — which comes from its being one of the easiest exchanges for beginners. You can buy its stablecoin Binance USD (BUSD) with fiat currency, then purchase any of 363 coins. You can also trade in Binance’s own coin, BNB, for a 25% discount on trading fees (10% on futures). Buying and converting take a few clicks each. Our Binance review has additional information.

Staking Products Available in the United States

Binance has run afoul of U.S. regulators before. In 2019, the exchange shut down in America after determining it could no longer comply with U.S. law in its current form. It launched Binance.US that same year. The two exchanges are similar, but Binance.US offers fewer currencies and trading pairs, with 166 assets compared to Binance’s 363.

There is, however, an upside to the relaunch as Binance.US: it’s allowed Binance to offer staking to American traders while most exchanges have been forced to shut it down. Staking lets you lock up your crypto for a length of time to accrue interest. You can also earn passive income through liquidity farming and get early access to new assets through Launchpool.

Binance and Binance.US have different fee structures. Both of them charge higher percentages than Crypto.com, with Binance.US being more expensive. If you pay your fees in BNB, you’ll get a 25% discount; the tables below show the basic non-discounted rates.

Here’s what you’ll pay on Binance everywhere outside the U.S. Keep in mind that your tier is determined not just by your money balance but by your BNB holdings — if you only meet one metric, you’ll get the fees in the lower tier.

| 30-day trading volume & BNB balance | Maker fee | |

|---|---|---|

| Less than $1M & less than 25 BNB | 0.1% | 0.1% |

| $1M to $5M & 25 to 100 BNB | 0.09% | 0.1% |

| $5M to $20M & 100 to 250 BNB | 0.08% | 0.1% |

| $20M to $100M & 250 to 500 BNB | 0.042% | 0.06% |

| $100M to $150M & 500 to 1,000 BNB | 0.042% | 0.054% |

| $150M to $400M & 1,000 to 1,750 BNB | 0.036% | 0.048% |

| $400M to $800M & 1,750 to 3,000 BNB | 0.03% | 0.042% |

| $800M to $2B & 3,000 to 4,500 BNB | 0.024% | 0.036% |

| $2B to $4B & 4,500 to 5,500 BNB | 0.018% | 0.03% |

| Greater than $4B & greater than 5,500 BNB | 0.012% | 0.024% |

Here’s what you’ll pay on Binance.US. On this side of the exchange, your tier is determined by your 30-day trading volume alone. Note that these fees do not apply to the two trading pairs designated as “Tier 0”: BTC/USDC and BTC/USDT. These trades are free, making Binance.US an excellent platform to sell Bitcoin.

| 30-day trading volume | Maker fee | Taker fee |

|---|---|---|

| Less than $10,000 | 0.4% | 0.6% |

| $10,000 to $50,000 | 0.25% | 0.4% |

| $50,000 to $100,000 | 0.15% | 0.25% |

| $100,000 to $1M | 0.1% | 0.2% |

| $1M to $20M | 0.08% | 0.18% |

| $20M to $100M | 0.05% | 0.15% |

| $100M to $300M | 0.02% | 0.1% |

| $300M to $500M | 0% | 0.08% |

| Greater than $500M | 0% | 0.05% |

4. Gemini

More details about Gemini:

- Pricing: $0.99 for all trades under $10; 0.5% fee on all trades

- Provider website: gemini.com

Pros:

- Never lost money in a hack

- Offers U.S. staking products

- Good API for trading bots

Cons:

- Highly expensive fees

- Needs full verification

- Sued for lending products

Gemini has positioned itself as the CEX you can depend on, a smart choice in an era when crypto’s legal status is as volatile as its prices. Gemini isn’t a defendant in the 2023 lawsuits — and although the SEC forced it to shut down its crypto lending program, the legal problems seem to have stopped there. It’s also one of the few exchanges whose funds have never been stolen by hackers.

There’s more to Gemini than just avoiding crises. Along with 106 cryptocurrencies, it also supports seven fiat currencies, which you can hold in your wallet while preparing to make a purchase.

Staking is also available, though only with Ether (ETH), Polygon (MATIC) and Solana (SOL). Perpetual futures contracts are the sole derivative so far, but more futures and options are supposedly on the way. Learn more in our full Gemini review.

The Gemini Custody Crypto Wallet

Gemini Custody is a crypto wallet you can set up without any starting fees. It’s a cold wallet, which means it can’t be accessed via the internet and thereby keeps your keys safe from hackers. In spite of that, you can trade assets directly from Custody thanks to a decentralized access process. Fees are expensive, though; check out our best crypto wallet article for some more affordable suggestions.

peace of mind may be worth it.

Gemini has two fee structures: one for its basic-level interface and another for its professional-oriented ActiveTrader dashboard. Basic orders placed via the web app or mobile app incur flat fees below $200, with a flat percentage for everything above. Each trade also incurs an additional 0.5% fee. Note that there’s no maker-taker dichotomy here.

| Transaction value | Fee |

|---|---|

| Less than $10 | $0.99+0.5% |

| $10 to $25 | $1.49+0.5% |

| $25 to $50 | $1.99+0.5% |

| $50 to $200 | $2.99+0.5% |

| Greater than $200 | 1.99% |

If you use ActiveTrader, you’ll pay much lower percentages, and the usual maker-taker dichotomy applies.

| 30-day trading volume | Maker fee | Taker fee |

|---|---|---|

| Less than $10,000 | 0.2% | 0.4% |

| $10,000 to $50,000 | 0.1% | 0.3% |

| $50,000 to $100,000 | 0.1% | 0.25% |

| $100,000 to $1M | 0.08% | 0.2% |

| $1M to $5M | 0.05% | 0.15% |

| $5M to $10M | 0.03% | 0.1% |

| $10M to $50M | 0.02% | 0.08% |

| $50M to $100M | 0% | 0.05% |

| $100M to $500M | 0% | 0.04% |

| Greater than $500M | 0% | 0.03% |

5. Kraken

its features are out of reach in the U.S.

More details about Kraken:

- Pricing: 0.16% for makers and 0.26% for takers on transactions under $50,000

- Provider website: kraken.com

Pros:

- Has never been hacked

- Holds fiat currency in wallet

- Basic & pro interfaces

Cons:

- No U.S. futures or staking

- Staking fined by SEC

- High fees for basic purchases

Kraken, like Gemini, focuses on protecting investors’ cryptocurrency from hackers. Its founder worked at Mt. Gox when that exchange collapsed due to massive thefts, and he applied the lessons learned to build a CEX that hasn’t been hacked yet. Even Gemini has had some passwords stolen, so where security is concerned, Kraken stands alone.

So why is it fifth on the list? Kraken hasn’t dodged the SEC, which fined it $30 million for failing to register its staking program as a securities market. It’s also been sued for firing an employee who claims to have tried to blow the whistle on unethical practices. This doesn’t project an aura of confidence, so we’d recommend trying another cryptocurrency exchange first. We’ve written a Kraken review that tells the whole story.

Kraken vs Kraken Pro

Kraken divides its web app into a basic section for newbie traders, just called Kraken, and an advanced spot trading panel called Kraken Pro. The simple Kraken interface charges much higher fees than Kraken Pro but offers fast conversions and minimal glitches. Kraken Pro is far more cluttered but almost fully customizable.

about the same as Gemini’s.

Kraken charges higher prices for instant buy transactions made on the basic interface. Stablecoin purchases cost 0.9% and all others cost 1.5%. Paying with a bank transfer (the recommended method) costs an extra 0.5%, so instant buy will cost you 2% the majority of the time. Kraken Pro charges the fees in the table below.

| 30-day trading volume | Maker fee | Taker fee |

|---|---|---|

| Less than $50,000 | 0.16% | 0.26% |

| $50,000 to $100,000 | 0.14% | 0.24% |

| $100,000 to $250,000 | 0.12% | 0.22% |

| $250,000 to $500,000 | 0.10% | 0.20% |

| $500,000 to $1M | 0.08% | 0.18% |

| $1M to $2.5M | 0.06% | 0.16% |

| $2.5M to $5M | 0.04% | 0.14% |

| $5M to $10M | 0.02% | 0.12% |

| Greater than $10M | 0% | 0.10% |

Cryptocurrency Exchanges: What’s the Difference?

We’ve touched on five different cryptocurrency exchanges in this article, but that hardly scratches the surface. This ranking by CoinMarketCap lists 226 exchanges, though there are probably over twice that many in operation. You’d be right to ask why they’re all necessary, especially since the U.S. has only 13 traditional stock exchanges.

Cryptocurrency exchanges have proliferated because it’s extremely easy to start one. Any computer serving as a blockchain node can be programmed to send and receive coins. Mt. Gox, the first successful exchange used to sell bitcoin, was built by an amateur. (It also collapsed after debilitating hacks, which reminds us to be careful with amateur work.)

Owning crypto exchanges can be hugely profitable, too. It’s like owning a bank, stock exchange and brokerage all in one. Of course, this opens the door to extreme levels of manipulation, which is one reason the SEC is cracking down hard on so many crypto exchanges.

As an end user, you’ll see two main differences between exchanges: the coins and trading pairs on offer, and the trading fees they charge. Some exchanges distinguish themselves with low fees, like Crypto.com, while others such as KuCoin make their mark through a wide selection of assets.

Final Thoughts: Crypto Exchanges

Ultimately, we recommend picking crypto exchanges with low trading fees, a good selection of coins, and enough security and regulatory compliance to stick around. Crypto.com does the best job of checking all those boxes — in fact, nobody else hits all three.

We’re not saying you shouldn’t use Binance.US and Coinbase, but you should use them wisely and very carefully. Although both have high liquidity and offer the potential for large gains, we cannot guarantee you’ll be able to withdraw your funds indefinitely. Gemini and Kraken are both slightly safer bets, though not quite as welcoming.

What’s your opinion on the best crypto exchanges? Did we miss any favorites or skip your favorite feature on the top five? Tell us all about it in the comments. Thanks for reading.

FAQ: Best Crypto Exchange Comparison for 2023

-

Our favorite is Crypto.com. It has high liquidity, plenty of coins and decently low fees — and has been safe from serious SEC enforcement so far.

-

Kraken is probably the safest exchange from hackers. It hasn’t lost money to theft since being founded in 2011.

-

Binance has the highest average cryptocurrency trading volume, though its counterpart Binance.US is in 39th place.

-

Avoid exchanges that can’t operate in the U.S., such as OKX.

{“@context”:”https:\/\/schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”:”Question”,”name”:”Which Exchange Is Best for Crypto Trading?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

Our favorite is Crypto.com. It has high liquidity, plenty of coins and decently low fees — and has been safe from serious SEC enforcement so far.\n”}},{“@type”:”Question”,”name”:”What Is the Safest Crypto Exchange Overall?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

Kraken is probably the safest exchange from hackers. It hasn\u2019t lost money to theft since being founded in 2011.\n”}},{“@type”:”Question”,”name”:”What Is the #1 Crypto Exchange?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

Binance has the highest average cryptocurrency trading volume, though its counterpart Binance.US is in 39th place.\n”}},{“@type”:”Question”,”name”:”Which Crypto Exchange to Avoid?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

Avoid exchanges that can\u2019t operate in the U.S., such as OKX.\n”}}]}

The post Best Crypto Exchange Comparison: 2023 Cryptocurrency App Roundup appeared first on Cloudwards.