Key Takeaways: Crypto Trading for Beginners

- Cryptocurrency is a type of digital currency that can be freely traded between peers. Each cryptocurrency is traded on a public ledger, which makes it possible to verify that crypto transactions are legitimate.

- A crypto exchange is a platform that gives users the tools to buy, sell and convert cryptocurrency.

- A crypto wallet holds the keys you need to access your cryptocurrency. Without the keys, you can’t access your money.

Cryptocurrency exploded into public consciousness with the meteoric rise of Bitcoin’s price in 2017. Despite becoming a household word, however, crypto hasn’t gotten any easier to understand. Whether you’re looking to invest or just understand the basics when it comes up in the news, our crypto for dummies guide is here to help.

Whether you like it or not, cryptocurrency is now relevant to your life. Dramatic collapses like the recent fall of FTX have repercussions in the wider economy, and mainstream businesses are jumping aboard the crypto train at increasing rates. A working knowledge of crypto is a vital asset in a modern economy.

The crypto world is saturated with trade talk and jargon, and it doesn’t help that many investors muddle their explanations on purpose to sound smarter. Sweep all that aside and you’ll find that the foundational principles of cryptocurrency aren’t as complex as they seem. You don’t need much tech savvy to grasp them — you just have to change the way you think about money.

Crypto for Dummies: Overview

We’ll start this guide with a basic overview of what cryptocurrencies are and how they work, including the different ways currencies gain value. We’ll also discuss exchanges, the various ways you can make money from crypto and how cryptocurrency wallets work.

A Brief History of Crypto

Cryptocurrency has its roots in the financial collapse of 2008, which revealed serious flaws in a banking system that relied on “too big to fail” institutions. The first to popularize both the concept of blockchain and its use as a banking ledger was “Satoshi Nakamoto,” an alias for a still-unknown person or group. “Nakamoto” launched Bitcoin as the first cryptocurrency in 2009.

When the first bitcoins were mined, they were barely worth pennies. Now, thanks to the 2017 price boom, a single bitcoin goes for tens of thousands of dollars. Other than Bitcoin, the biggest contributions have come from Ethereum, which pioneered the use of blockchain to verify contracts and provide other decentralized services.

Before We Begin: Crypto Basics

The first, most basic thing to grasp about crypto is that it’s mostly the same as any other currency: a limited resource you can trade for goods or services of equal value. The money itself has value because people agree it has value. The U.S. dollar, for example, is valuable because it is used in trade and backed by a recognized government.

The main difference with crypto is that it’s decentralized. In traditional non-crypto currency, known as fiat currency, an authority like a federal reserve or central bank verifies that transactions are legitimate. Transactions with cryptocurrency are instead verified by being entered in a public ledger known as a blockchain.

This grants crypto its biggest advantage: It can be traded between two peers without any intermediaries being involved. This doubles as its biggest downside, though: The lack of an intermediary means a cryptocurrency’s value fluctuates a lot more wildly than that of a fiat currency.

What Are Cryptocurrencies?

By this point, we’ve learned that a cryptocurrency is a virtual currency that can be traded from person to person without approval from a centralized authority. In this section, we’ll unpack exactly how cryptocurrencies manage to work without the support structures of traditional money.

What Is Blockchain?

As cryptocurrencies use a blockchain in place of a central authority, blockchain is inseparable from crypto itself. If you can understand it, you’re already most of the way there.

A blockchain is a public ledger where every transaction is visible. When we say a cryptocurrency is “built on” a blockchain, we mean that any transactions using that currency are entered into the ledger. Once a block exists, you can’t change it; you can only add new blocks. Since the blockchain is distributed across many devices, nobody can be cut off from viewing it.

These two properties — being public and being distributed — make it possible to verify transactions on the blockchain. A block must be verified before it can be added to the blockchain. Verification gives crypto its value, since it ensures that each crypto coin is a unique object that can’t be spent without losing it.

This also means that most crypto is not anonymous, since visibility is the whole purpose of a blockchain. Your name will not be attached to your crypto holdings, but your digital wallet has a pseudonymous identity that’s 100% visible. If you’re worried about having it traced back to you, you can always use a VPN for crypto trading.

One more important note about blockchains: In an ideal world, they would be perfectly distributed; in practice, few achieve total equality. To ensure a cryptocurrency does its job, most of them require some kind of management structure, often a decentralized autonomous organization (DAO).

The bitcoin blockchain grants bitcoin value because every bitcoin transaction is visible to the entire public, so they can all be checked for legitimacy. This is the general principle behind every other cryptocurrency. Next, let’s talk about the two most common ways that verification can happen: mining and staking.

Mining Digital Currency

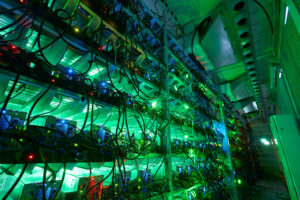

Let’s start by discussing mining. Because it’s used by bitcoin (not the only cryptocurrency, but the best known and highest valued), it’s the better known method. However, mining is actually on the decline in crypto due to its heavy energy costs and comparative unreliability.

Although the term “mining” suggests that miners are discovering cryptocurrency that already exists in a cache somewhere, this impression is inaccurate. Crypto miners are actually being rewarded for adding blocks to the blockchain by verifying transactions.

Here’s how it works. Each new block added to the blockchain is associated with a unique number called a hash, generated by applying a math formula to that block’s data. Miners try to verify the block by generating that same unique hash with a certain number of zeros in front of it. Whoever generates the hash with enough zeroes first adds the block to the chain.

In exchange for making transactions possible, miners who succeed in adding blocks to the chain are rewarded with crypto coins. In other words, the same labor that makes it possible to trade cryptocurrency is also what puts new cryptocurrency into circulation. This is why mining is also known as the proof-of-work method.

Since there’s essentially no way to hit the target hash without randomly trying as many answers as possible, crypto mining requires a lot of processing power — so much that many fear it’s making a significant contribution to climate change; for example, Bitcoin mining consumes more power than the entire country of Argentina.

The staking method in the next section, with its much lower costs, has lately overtaken mining in popularity.

Staking Digital Currency

Crypto mining works because it’s technically possible for anybody to be a validator, so long as they contribute processing power (though in practice, most rewards are now claimed by massive consortiums).

The proof-of-stake method chooses its validators in a different way. Instead of rewards going to whoever contributes the most power, a cryptocurrency running on proof-of-stake selects from among people who hold that currency. The more of the currency you have, the more likely you are to be chosen as a validator.

Investors chosen as validators are rewarded with more currency. They also get a vote to determine whether a given transaction on the blockchain should be legitimized. If a simple majority (50%+1) validators vote “yes,” the transaction goes on the ledger.

Although mining came first, staking is now almost universally seen as the more elegant validation method. Ethereum, arguably the second most famous cryptocurrency after bitcoin, switched from proof-of-work (mining) to proof-of-stake in 2022.

The main drawback to staking is that most people will never hold enough of the currency to have a chance of getting selected. However, many proof-of-stake cryptocurrencies support minor staking investments, in which users can lend their currency to bigger investors who have a chance to become validators. In return, the validators pay the users back with a bit of interest.

Crypto exchanges often simply refer to this practice as staking, but it’s more properly contributing your money for other people to do the actual staking. In practice, it’s a lot like a high-yield savings account, as you temporarily lose access to your money in order to make more.

What Are Stablecoins?

Some digital currencies are known as stablecoins because their prices aren’t supposed to fluctuate like those of other cryptocurrencies. Instead, a stablecoin (in theory) has the same value as a designated fiat currency, such as Tether (USDT), which is always worth the same as the U.S. dollar.

Stablecoins form a useful middle ground between fiat and crypto, letting users purchase blockchain services and make trades without significant volatility. However, depending on how a stablecoin maintains its price, it can still collapse — the 2022 fall of TerraUSD is the best known example.

Benefits of Using Crypto Coins

By this time, you might reasonably be asking what the point of all this is. What can you do with cryptocurrency that you can’t do with fiat currency?

As we’ve covered, the main point of cryptocurrency is to complete transactions without oversight. If you have any reason not to trust a central bank, or you disagree with its methods, crypto lets you bypass the institution altogether. The lack of a middleman also means that transactions can process much more quickly, often in seconds.

For many, however, cryptocurrency is less about actually spending it (the number of places you can do so is limited anyway), and more about speculating on its price. Rapid price fluctuations mean crypto coins can gain value quickly, outpacing both inflation and the traditional stock market. Some early investors became millionaires practically overnight.

One final benefit is that corruption in cryptocurrency is theoretically impossible, thanks to the totally open nature of blockchain technology. Note, however, that this only applies to tampering with the ledger itself; even a secure wallet or exchange can be hacked, and fraud is relatively common.

Drawbacks of Cryptocurrency

Cryptocurrency promises an exciting financial future, but it’s not without its downsides. The biggest thing to beware of if you trade crypto is its high price volatility. Prices can surge, but they can collapse just as quickly. Since a crypto coin has no inherent value, it’s often considered a bubble, liable to burst from just a few days of bad news.

The other biggest drawback is that cryptocurrency is mostly unregulated, since governments around the world haven’t yet caught up to the industry. The resulting “Wild West” atmosphere has attracted crime and corruption, from the massive hack that destroyed Mt. Gox to the collapse of FTX under Sam Bankman-Fried.

What Are Exchanges?

Most people who hold stocks don’t buy them on the trading floor at the New York Stock Exchange. Instead, they trust middlemen to handle their investments, picking brokers and money managers who know the system better than they do. Most of those who want to pick their own stocks still choose a service like Vanguard or Charles Schwab to make it easier.

It’s the same with cryptocurrency. You can buy and sell crypto manually, but it takes a lot of technical knowledge and comes with very few side benefits. It’s a lot easier to use an exchange to buy cryptocurrency, as it comes prepackaged with all the tools you need to trade. Most exchanges offer other ways to make money, like the staking we discussed in the last section.

The best known exchanges, such as Coinbase (as you’ll see in our Coinbase review) aim to offer user-friendly interfaces for beginning traders, paired with more complex spot trading features for those with advanced knowledge. It’s almost always free to set up an account — exchanges make their money by taking a percentage fee from each transaction.

The exact amount you’ll pay usually depends on a few factors, such as the amount you hold in your digital wallet, the amount you trade per day and whether you’re a “maker” or a “taker” (see the next section). Make sure you always understand the fee schedule before putting any funds into an exchange.

Trading on the Cryptocurrency Market

When we talk about “trading crypto,” we’re most often referring to one of three basic actions: using fiat currency to buy cryptocurrency, selling cryptocurrency for fiat currency, or trading one cryptocurrency for another.

Buying, Converting & Selling Crypto

To buy crypto, you agree to exchange a certain amount of fiat currency for a particular cryptocurrency. There are two ways to do this. You can buy instantly at the current price, which makes you a taker, or place an order to buy a certain amount of crypto as soon as it reaches a specified price, in which case you’re a maker.

Makers often get better trading fees, and are even paid by the exchange in some cases. To understand why, remember that an exchange is a business that depends on keeping cash on hand. If you commit money for a later purchase, the exchange gets liquidity it can reinvest somewhere else.

Trading one cryptocurrency for another is known as converting crypto, and can often be done instantaneously and without fees. If you can predict where the price of a digital asset will go, you can make big profits this way. Say you’ve converted your Bitcoin into Ethereum — if Bitcoin drops or Ethereum rises, you can increase your BTC holdings without paying a cent.

Finally, you can sell crypto in exchange for traditional currency, which most exchanges describe as a withdrawal. As we’ve explained, exchanges want to hold as much liquidity as possible, so withdrawal fees can be quite high to encourage you to leave your money where it is.

Margin & Futures Trading

Once you’re more comfortable with the world of cryptocurrency, exchanges offer a few higher-risk, higher-reward investments. For example, there’s margin trading, in which traders borrow money to buy more crypto at once. You can make more profit this way, but there’s also the potential to lose far more than you started with.

There’s also futures trading, which lets you buy and sell contracts to purchase crypto on a future date. You can short a coin by selling a futures contract, effectively selling the coins before you buy them; if the price goes down, you’ll make a profit on the purchase and resale.

Some exchanges let users loan out their cryptocurrency to others for margin trading. If you’re sitting on crypto funds and want to make them work for you, this can be more profitable than staking.

Investing in Cryptocurrencies

If you’re still reading, you’d probably like to know how people most often make money via cryptocurrency investing. The first thing to know is that success is not guaranteed. Only 28% of American crypto holders said they had ever sold a crypto asset for more than they paid for it. Go in with a strategy, and be prepared to cut your losses.

As with all forms of asset trading, your objective is to buy low and sell high. The easiest way to do this is to predict which coin will increase in price, buy that coin, hold it until you think the price is about to peak, then sell it off. Some traders profit by “buying the downswing” — buying a currency whose price is dropping, assuming a rise will come after the fall.

Spot trading, margin trading and futures trading are all variations on the buy low/sell high objective. If you want a surer thing, you can make a decent passive income by staking your coins or lending them out.

We don’t recommend trying to make a profit through mining. Not only does it take a massive amount of processing power to have a chance, but proof-of-work cryptocurrencies regularly debase the value of newly mined coins in order to control inflation.

Finally, there are a few ways to earn small amounts of crypto through giveaways or games like Axie Infinity. If you choose this route, be extremely careful, as giveaways are a common vector for scams.

Choosing a Crypto Exchange

Before looking into any exchange, make sure it’s licensed to trade in your country. Several exchanges such as OKX (see our OKX review) have pulled out of the U.S. due to increasing regulations, and China banned cryptocurrency altogether in 2021.

Check that the exchange supports the digital assets you want to trade — not all exchanges trade in all cryptocurrencies. Look for low trading fees, an easy-to-use interface and a strong record of securing users’ digital assets against hackers.

What Are Crypto Wallets?

Just like “mining” crypto is a euphemism for a more complex process, a crypto wallet isn’t actually a place for storing cryptocurrency. Remember that cryptocurrency only exists on its associated blockchain technology — actually locking it away from others would defeat the purpose.

A crypto wallet is more like a password manager than an actual wallet. It stores the keys you need to prove your crypto assets belong to you. With your public and private keys, you can lay claim to data on the blockchain; if you lose them, you may as well not have that money at all.

Managing your credentials is a wallet’s most important function, but it can also work like an online bank account, tracking your balances and letting you make purchases and transfers. Some wallets act as gateways to exchanges; currency you buy on the exchange goes into your wallet and can be used for future trades.

Keeping Crypto Assets Safe

Crypto wallets are simple. Even just writing your keys down on a piece of paper technically counts as one. A wallet that protects your keys from theft is another matter. One option is a USB hardware wallet that contains your keys; only a computer with the hardware wallet inserted can access your cryptocurrency.

If you start trading through an exchange, chances are you’ll keep your crypto in a software wallet instead. These can track your assets and can’t be physically stolen since they’re entirely online — though they are vulnerable to hacking.

In other words, a software wallet offers more convenience, while a hardware wallet comes with greater security. We’ve put together a list of the best crypto wallets in case you’re interested in finding out more.

Final Thoughts: How Crypto Works

Cryptocurrency is still in its infancy. Although it’s already been through several boom-and-bust cycles, it remains full of untapped potential. Is decentralized currency the future of money, or will this all turn out to just be a sideshow?

The only thing we can say for sure about crypto is that it’s no longer possible to ignore it. The more you understand about cryptocurrency, the better you’ll be able to decide how much you want to involve it in your own life. If you know the risks and have a clear objective, trading can be lucrative and even fun.

We hope this guide has helped you get your head around the famously esoteric concepts underpinning cryptocurrency. Are there any subjects you’re still lost on? Do you disagree with any of our claims, or think we missed something important? Let us know in the comments, and thanks for reading!

FAQ: Crypto for Dummies

-

A cryptocurrency is a unit of money that can be traded on a distributed network without going through a bank or central government. A crypto “coin” is actually a string of data written on a public ledger known as a blockchain.

-

Coinbase has our favorite user interface for crypto trading. Beginners will find it friendly and helpful.

-

Yes! Most exchanges have a minimum transaction value, but it’s almost always much lower, in the $10 to $20 range.

The post Crypto for Dummies: Explaining How Cryptocurrencies & Exchanges Work for Beginners appeared first on Cloudwards.