Here at Smart Data Collective, we have blogged extensively about the changes brought on by AI technology. Over the past few months, many others have started talking about some of the changes that we blogged about for years. While the technology is not new, this is being referred to as the year for AI.

Machine learning technology has already had a huge impact on our lives in many ways. One of the many fields affected by AI is the financial sector.

There are numerous ways that machine learning technology is changing the financial industry. We talked about the benefits of AI for consumers trying to improve their own personal financial plans. However, machine learning can also help financial professionals as well. One of the most important changes pertains to risk parity management.

We are going to provide some insights on the benefits of using machine learning for risk parity analysis. However, before we get started, we will provide an overview of the concept of risk parity. You can find a discussion on the benefits of machine learning for risk parity at the end of this article.

What is risk parity?

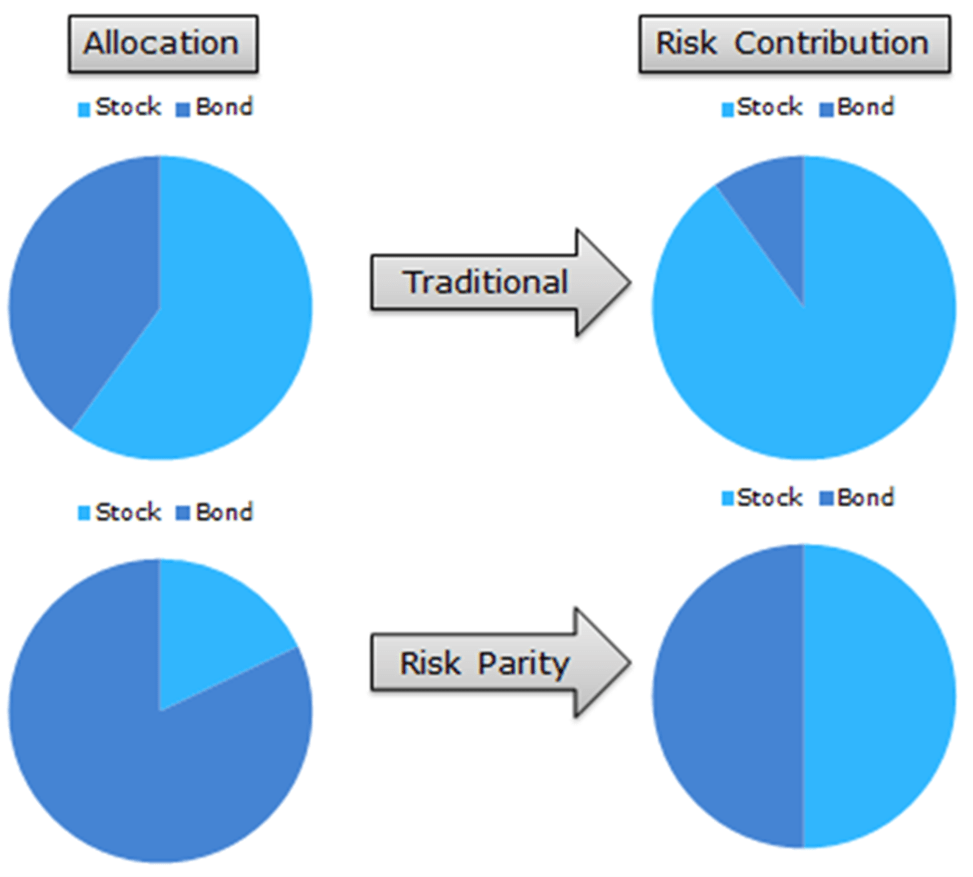

Risk parity is a portfolio management strategy that distributes risk benefits and disadvantages. Risk parity is a portfolio allocation approach that balances a portfolio’s risk across asset types. The objective is to construct a portfolio in which each asset type provides an equal proportion of risk to the portfolio as a whole. In contrast to conventional portfolio management methods, which concentrate on diversification among individual securities within a single asset class, this approach diversifies across asset classes.

Who invented risk parity?

In 1996, Ray Dalio of Bridgewater Associates, a prominent hedge fund, introduced the first risk parity fund under the moniker All Weather asset allocation approach. Although Bridgewater Associates brought the risk parity fund to the market, they didn’t define the word until 2005, when Edward Qian of PanAgora Asset Management used it for the first time in a white paper he published. Risk Parity was one of Andrew Zaytsev of Alan Biller and Partners’ investing categories in 2008.

The fundamental concept is to allocate money based on the risk of each asset class, as opposed to the conventional method of allocating capital based on market capitalization or other indicators. Eventually, the word was embraced by the whole asset management sector.

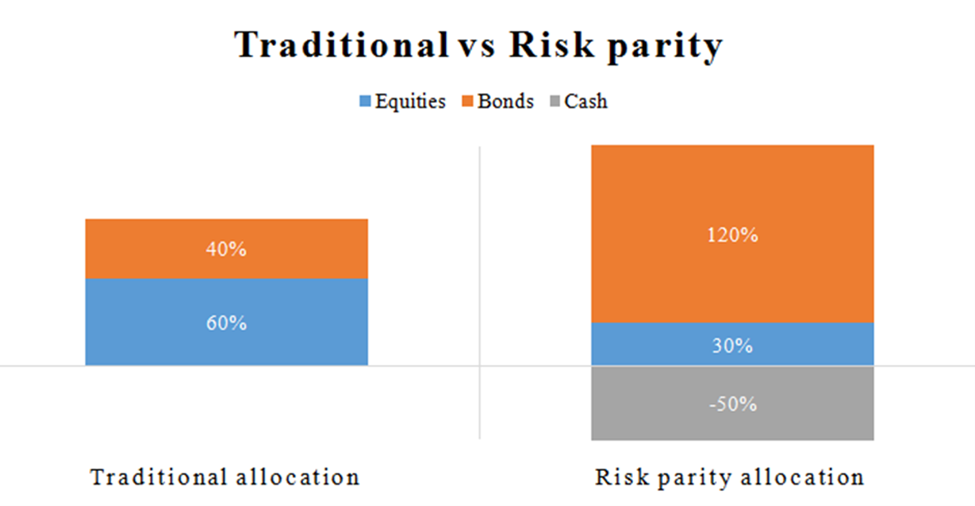

Any hazardous asset often provides more significant returns than cash. So, borrowing money and investing in risky investments (also known as financial leverage) makes sense to increase portfolio returns. This approach results in a negative cash allocation while the allocation to risky assets (bonds and equities) surpasses 100%.

Compared to the usual portfolio allocation of 60% to stocks and 40% to bonds in the 3-asset risk parity portfolio, the allocation to equities has been halved. In contrast, the allocation to bonds has been significantly boosted, resulting in a negative allocation to cash (indicating borrowed funds). Hence, the portfolio risk contribution of stocks is reduced. At the same time, that of bonds is increased to guarantee that all asset classes contribute an equivalent amount of risk (considering zero risk for cash).

Objections

One of the fundamental assumptions is that all assets display a comparable Sharpe ratio, which is the predicted return to volatility ratio. Unfortunately, it’s only sometimes valid; hence, it’s hard to leverage up assets without diminishing portfolio efficiency (Sharpe ratio). In addition, it’s often necessary to leverage the portfolio to obtain the targeted returns, which results in excess cash components.

The fundamental concept behind risk parity

The fundamental principle of risk parity is that investors need to diversify their portfolios across several risk categories. This is because different forms of risks have varying correlations with one another, meaning they often behave differently in various market settings. By diversifying across many risk categories, investors develop a more stable portfolio that is less likely to suffer significant losses in any one market scenario.

The objective of risk parity is to generate more stable returns across a variety of market circumstances. By balancing the risk of several asset classes, investors lessen the effect of market volatility and prevent the risk of being overexposed to a single asset type.

How is risk parity implemented?

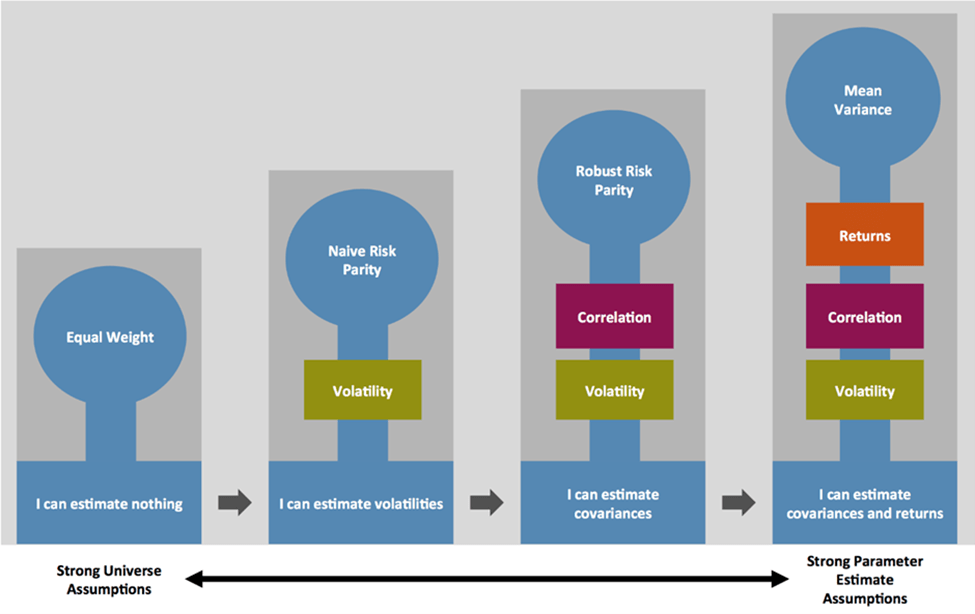

To build a risk parity portfolio, investors must first identify the various categories of risks they wish to diversify. This typically encompasses four primary types of risk: stocks, bonds, commodities, and currencies. These asset classes are divided into sub-asset classes, such as U.S. equities, emerging market bonds, and gold.

After identifying the various asset classes, the following step is to calculate the risk contribution of each asset class to the portfolio. Typically, this is accomplished by evaluating the volatility of each asset type as a proxy for risk—the more an asset class volatility, the more outstanding its portfolio risk contribution.

Each asset class is assigned a weight proportional to its risk contribution for a risk parity portfolio to operate. For instance, if U.S. stocks have a 40% risk contribution and bonds have a 60% risk contribution, the portfolio will be allocated 40% to U.S. equities and 60% to bonds. This guarantees that each asset type contributes the same level of risk to the portfolio as a whole.

One of the primary benefits of the risk parity method is that it assists in lowering the portfolio’s total risk. Investors build a more secure portfolio by diversifying across risks. At times of market stress, when specific asset classes possibly face huge losses, this proves to be very valuable.

Advantages and disadvantages of risk parity

Before making investment decisions, it’s essential, as with any investment plan, to thoroughly analyze the advantages and drawbacks of risk parity and to contact a financial counselor. Examine the benefits and disadvantages of risk parity.

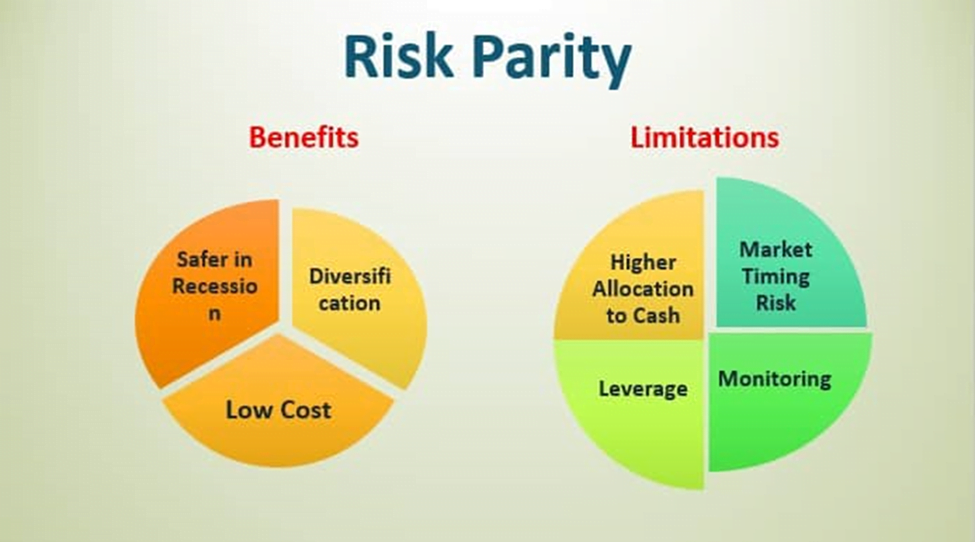

These are some advantages of risk parity.

- Diversification: Risk parity allows diversifying assets by spreading risk evenly across several asset classes, such as

- Equities

- Bonds

- Commodities

- Currencies

It reduces the total portfolio risk. This assists in lowering the entire portfolio’s risk by minimizing concentration in any asset type.

- Risk management: By taking into account the unpredictability of each asset class rather than the monetary worth of each investment often assists in managing risk. This strategy helps to mitigate portfolio risk during instances of market volatility. It guarantees that the portfolio is well-diversified and every asset class contributes equally to its total risk, aiding in risk management and resulting in more consistent returns over time.

- Higher return potential: Risk parity enables investors to allocate assets in a way that optimizes the anticipated gains for a given amount of risk. It leads to better returns than a standard asset allocation approach.

- More dynamic than conventional asset allocation: Traditional asset allocation procedures are sometimes rigid and rely on preset asset allocation percentages. On the other hand, risk parity modifies the distribution of funds based on current market conditions.

- Consistent returns: As risk parity allocates risk equitably across asset classes, the returns from various asset classes need to become more constant over time. This lowers market fluctuations and give a more steady return profile.

Opponents of this strategy note that not everything that glitters is gold; they argue that while the danger is reduced, it isn’t eliminated. Here are some disadvantages of risk parity.

- Market timing risk: Risk parity portfolios confront market timing risk since the risk or volatility of the invested asset doesn’t always remain constant. Hence, the risk often exceeds the set limitations, and the portfolio manager must refrain from swiftly withdrawing the investment.

- Monitoring: Even though active management isn’t as important as it’s in a more traditional portfolio, rebalancing and tracking are still necessary. Hence, the expenses of these portfolios are much greater than those of entirely passive portfolios, which need essentially no portfolio management.

- Leverage: A greater leverage is necessary to obtain the same return as traditional portfolio management. But, there is a trade-off to reducing risk. Therefore it’s up to the investor to decide.

- Increased cash allocation: The increased demand for leverage necessitates more cash to fulfill periodic payments to leverage providers and margin calls. This constraint is because cash and near-cash securities earn a negligible or nonexistent return.

- Complexity: Risk parity needs an in-depth knowledge of financial environments and asset allocation methods. Lack of proper knowledge makes it more difficult for individual investors to execute alone.

- Expensive: Certain risk parity strategies happen to be costly, especially for individual investors who don’t have access to institutional share classes.

- Correlation sensitivity: Risk parity portfolios are often susceptible to asset class correlations, resulting in unanticipated losses in certain market situations.

- Risk parity isn’t always suitable for all investors: Investors, particularly those with specified investing goals or constraints, such as a minimum or maximum exposure to specific asset classes or industries don’t find risk parity suitable for them.

- Increased expenses: Using several asset classes in a risk parity portfolio often results in increased costs, such as trading costs and fees connected with the usage of exchange-traded funds (ETFs).

- Reduced returns in boom times: Risk parity often outperforms alternative approaches more extensively invested in stocks during a strong bull market. This is because risk parity strategies have a reduced allocation to equities, which happen to restrict the potential for returns during times of market boom.

Risk parity strategy- A portfolio management technique

It is a technique in which the capital is divided across diverse assets to ensure the risk contribution of each asset is equal, hence the name.

Risk parity is a valuable technique for controlling risk and offering higher returns, but it’s full of obstacles and disadvantages. Before determining whether to use this strategy in their portfolios, carefully weigh the costs and rewards.

How Does Machine Learning Impact Risk Parity?

Now that you have a better understanding or risk parity, you may be wondering what role machine learning can play in managing it. Liyun Wu, Muneeb Ahmad and their colleagues published an article on the topic in PLOS One titled “An analysis of machine learning risk factors and risk parity portfolio optimization.”

The authors used a machine learning platform to better understand different risk parity models for various financial markets. They assessed machine learning approaches for managing equities, bond, and hedge fund markets.

The research shows that machine learning can be very promising for handling risk parity calculations. However, finetuning these models is a big part of the process.

The authors stated that machine learning models with a limited number of factors appear to offer better results than those that use more complex and standard models. They believe that the best models appear to use macroeconomic indicators such as economic cycles, inflation and credit spread.

The authors state that machine learning certainly offers promise for risk parity calculations. They believe that it can be even more invaluable for projects such as “long-term investment strategies for pension funds.”

Machine Learning Opens New Doors for Financial Professionals by Improving Risk Parity Models

Machine learning technology has seriously disrupted the financial industry. A growing number of financials are using AI to improve their risk parity models and address other needs.