McKinsey predicts that generative AI could add $200-340 billion in annual value to the banking sector, which would mostly come from productivity increases. The consultancy says that Gen AI will change the way customers interact with financial institutions and how everyday tasks are approached.

Do you feel like this is an exaggeration? Let’s explore what generative AI can do for the financial sector. And, as a Gen AI consulting firm, we will share our expertise on how to get started with the technology in your financial institution and which challenges to expect along the way.

Impact of generative AI on the financial sector

First, how does Gen AI differ from artificial intelligence?

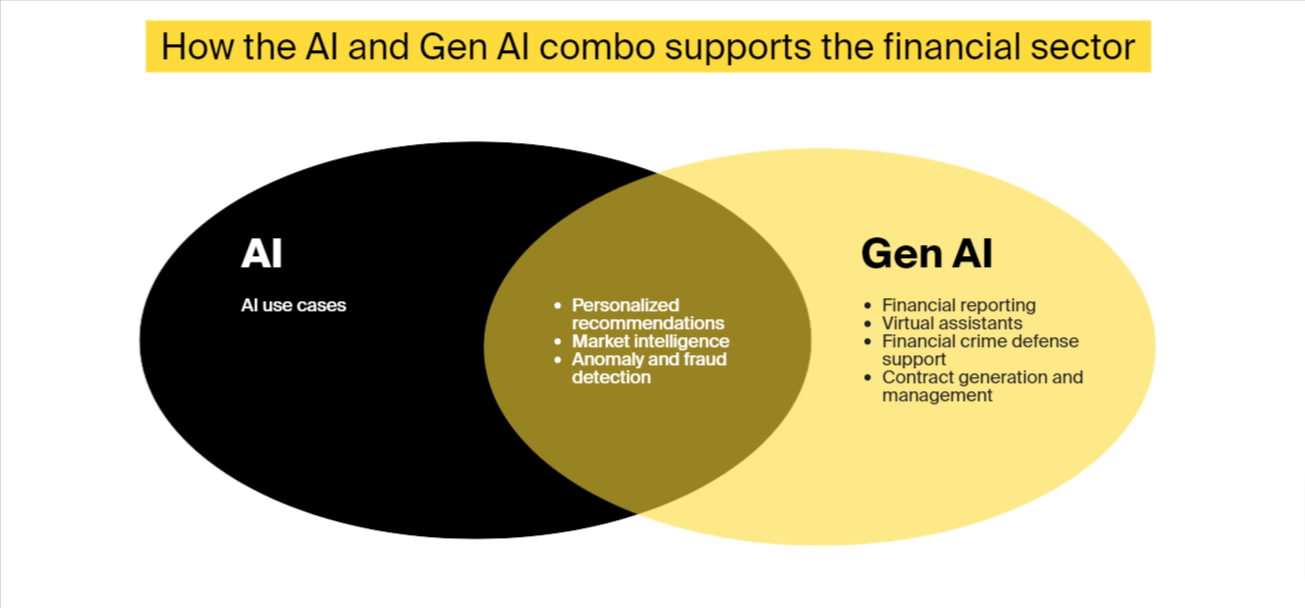

The classic AI is mostly used for classification and prediction tasks, while Gen AI can deliver original content that looks like human creation. For example, a conventional artificial intelligence model can tell you if an object in an image is a cat; a Gen AI model can generate a picture of a cat based on its knowledge base of other cat images.

You can find more information on the distinctions between Gen AI and AI on our blog.

Now, let’s get back to generative AI.

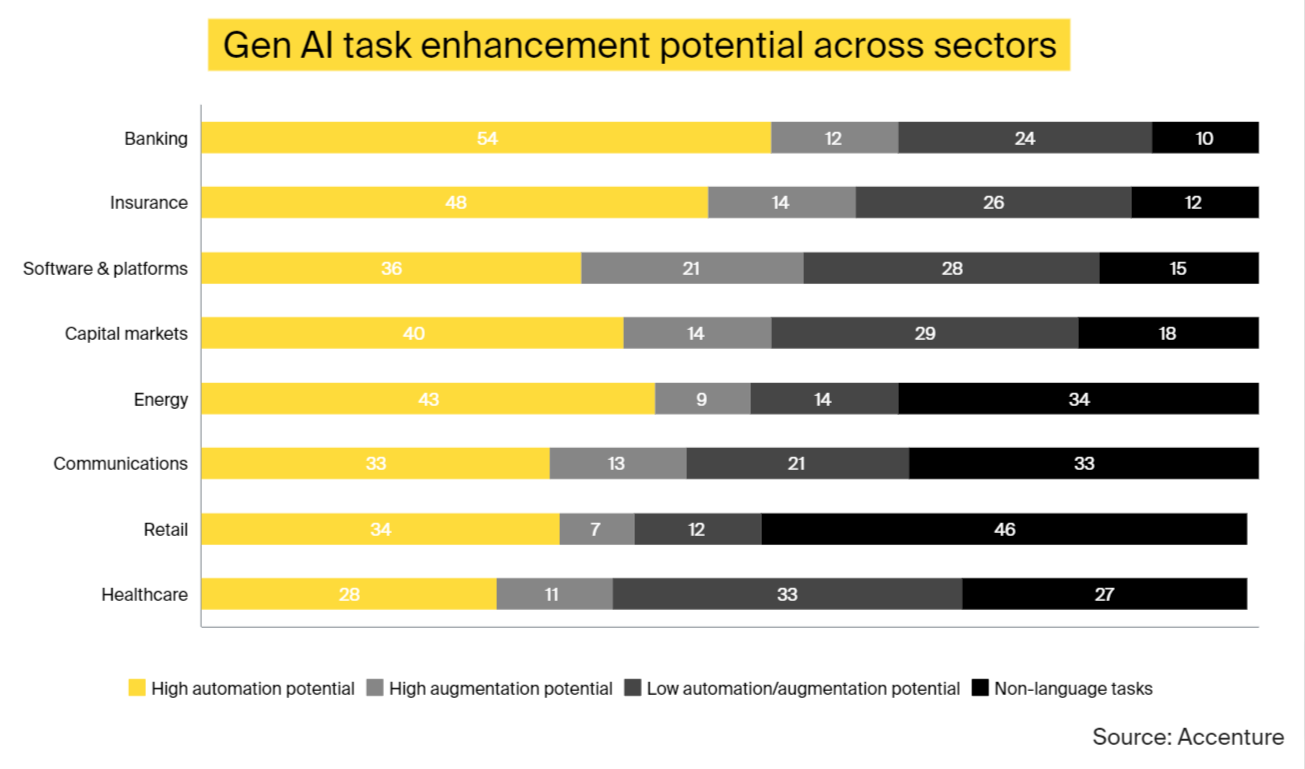

Accenture believes that banking and insurance have the largest potential for automation using Gen AI.

Currently, generative AI is mostly helping the financial sector automate manual tasks and deliver financial services. It still can’t handle end-to-end automation of processes without human intervention. For example, the technology can’t discover an early trend, devise a strategy on how to use it to a company’s advantage, and execute the strategy autonomously. Or craft a personalized customer investment portfolio and put it to action automatically without human verification.

Wide-scale adoption is slow because of the sensitive nature of financial institutions’ operations, data privacy, and the organizations’ fiduciary duty to protect customers from misinformation and deceptive output.

But here are four solid benefits that generative AI already brings to the financial sector:

- Lower costs. According to a recent MIT report, the real value of generative AI in the financial sector lies in cost reduction. And the majority of these reductions will come from automating manual tasks and freeing employees’ time to do higher value work.

- Higher productivity. Accenture found that large language models can affect 90% of all working hours in the banking sector. And BCG states that companies that deploy Gen AI tools can increase productivity by up to 20%.

- Better customer experience. Generative AI is good at personalization. For example, Magnifi offers an investment platform that uses ChatGPT and other software to give users personalized investment advice. And this is only one example. Gen AI can also support employees in their communications with clients, helping them locate information faster and reduce waiting time.

- Greater resilience and risk management. FinTech generative AI can minimize risks associated with financial products and services. For instance, a North American bank relies on Gen AI models to analyze loan applicants’ financial data. This helps avoid the risk of customers defaulting on loans.

Key 7 generative AI use cases in financial services

Disclaimer: In some of the highlighted use cases, businesses need to strategically combine traditional and generative AI to unlock the most value. In other scenarios, Gen AI does the job on its own.

Use case 1: Financial reporting, summarization, and information analysis

Financial generative AI can learn to draft financial reports, such as financial statements, budget, risk, and compliance reports. Human employees will then review these drafts and adjust them as needed.

Gen AI models can go through extensive amounts of data and present insights in concise, understandable summaries. These tools can also respond to queries and extract short answers from large document heaps. For instance, a cyber insurance company, Cowbell, introduced its MooGPT tool, which can search the firm’s financial knowledge base and give short answers to insurance agents in real time when they are on the phone with a policyholder.

Use case 2: Personalized financial recommendations

Another application of generative AI in finance is segmenting customers based on their financial status and demographics. Brokerage firms can use this division to produce recommendations tailored to customer groups.

There is also research into FinTech generative AI models that could pick investment assets for a balanced portfolio. Another research avenue is building algorithms that can process incoming news and evaluate its impact on asset pricing.

JPMorgan is developing its own Gen AI bot, IndexGPT, which will give customized investment advice by analyzing financial data and selecting securities tailored to individual customers and their risk tolerance.

Use case 3: Virtual assistants

Gen AI-powered tools can act as assistants to human employees in different functions.

One example is an AI coding assistant that helps developers build financial software and discover bugs. Goldman Sachs is experimenting with generative AI to assist programmers with code writing. The company witnessed a 20-40% increase in productivity in their software development department.

In another example, KPMG is using its long-term partnership with Microsoft to access OpenAI’s technology to support its tax department. Now, every tax consultant has access to a ChatGPT tool residing within KPMG’s firewall. The consultancy wants to incorporate ChatGPT into other products and services and expects as much as $12 billion in revenue from these initiatives.

Use case 4: Defense against financial crime

FinTech generative AI can spot suspicious financial activities and help with crime investigation.

A crime and risk management software company, NICE Actimize, built a Gen AI-powered tool to support human workers in investigating financial crimes. It can analyze and summarize data, issue alerts, generate reports, and more. The company claims that its tools can cut the investigation time by 50% and even by 70% when it comes to suspicious activity report (SAR) filing.

Use case 5: Market intelligence

Large language models can crawl the internet and social media platforms to discover market insights, such as shifts in demand, and gather intelligence on the competition.

Morgan Stanley’s Wealth Management department deploys OpenAI technology to mine the bank’s proprietary data. And Bloomberg recently released its BloombergGPT – a large language model that was trained on an enormous financial dataset containing 700 billion tokens. People can use this Gen AI model to search Bloomberg’s financial data and obtain summaries and financial insights.

Another application of finance generative AI in this context is to simulate various market scenarios, evaluate potential outcomes, forecast market trends, and show how these will affect investment portfolios.

Use case 6: Contract generation and management

By analyzing enormous sets of specialized documents, Gen AI can learn the nuances of legal language and produce drafts of different contract types. It can help articulate non-standard terms, compare contract conditions, produce summaries, and generate arguments for negotiating favorable terms.

An American financial corporation, BNY Mellon, traditionally spent lots of time handling custodial agreements. For each agreement, there was a team of lawyers who composed a draft and navigated a complex approval system. The company hired an AI vendor to customize a generative AI model to streamline custodial agreements. Not only did this tool produce solid customized drafts, but it also sent these drafts to the corresponding stakeholders, alerting them to any non-standard clauses and missing details.

Use case 7: Anomaly and fraud detection

According to a 2023 KPMG survey, fraud detection came on top of the list of generative AI applications in finance, with 76% of the respondents saying the technology benefits this cause.

Gen AI can monitor financial transactions in large organizations in real time and spot any anomalies, such as sudden changes in spending behavior. These models can also flag suspicious collaborations involving complex fraud schemes.

FinTech firms can also rely on Gen AI to spot suspicious actors on their platforms. Stripe, an Irish-American financial services company, uses GPT-4 to identify malicious actors on its community forum. The tool can flag questionable accounts and notify Stripe’s fraud team members to investigate.

Check out our recent article on generative AI in banking if you are eager to explore more specialized banking applications. We also have a general guide on Gen AI use cases in business if you are looking for industry-independent ideas.

Challenges of implementing generative AI for financial services

- Legacy technology. Financial institutions were among the first to adopt technology back in its early days. Sadly, many organizations still stick to the legacy software systems that gave them a competitive edge in the past. Research shows that the old programming language COBOL still supports 80% of credit card activities and 85% of ATM transactions. This and other old technologies, systems, and isolated data silos that fit the purpose back in the day are ironically hindering progress now.

- Lack of talent. Generative AI is a relatively new technology, and there is not enough expertise in the talent market. But history shows that this is not a long-term problem, as people will gain experience and qualifications over time.

- Bias and lack of explainability. Gen AI models are as fair as their training datasets. They can train on any data available on the internet, absorb, and reflect its toxicity. One classic example in finance is discrimination in credit allocation. Gen AI algorithms can exhibit bias against certain population cohorts. And the fact that advanced Gen AI models are black-box by design and can’t explain their outcome only exacerbates the situation.

- Model hallucination. Gen AI can confidently offer plausible but incorrect information. If you are a financial advisor, a hallucinating model will strongly undermine your competence in front of clients.

- Intellectual property rights. These large models can train on data from public sources while also using IP-guarded information without permission. For example, if you want to ask Gen AI to write a financial app and it trains on licensed financial software and produces something similar, this would violate IP rights. And another question here is whether you can license software written with Gen AI.

- Regulatory uncertainties. There are many unanswered regulatory questions surrounding Gen AI in finance. What should we do if an algorithm learns to manipulate prices? If you are a customer who received terrible financial advice from your bank’s Gen AI, who can you sue? What if malicious actors use this model to manipulate the market? In the worst-case scenario, this can threaten the country’s financial stability.

Implementing generative AI in finance: a step-by-step guide for CFOs

These steps will help you prepare for Gen AI deployment and avoid problems while using the technology in the future.

Select the right Gen AI use cases in finance

Start experimenting with only a few business cases that have a tangible effect on the financial function, are not overly complex, and are backed by key stakeholders.

Don’t rush into Gen AI initiatives just because of the technology. Don’t gallop wildly to turn all your operations into one big chatbot. There is no need to invest in Gen AI for cases where other less advanced and cheaper technology can do the job just as well.

Decide on building vs. buying a finance generative AI model

Building a foundation model from scratch isn’t feasible for most companies because Gen AI development costs are excessively high. So, you can choose from the following, more affordable options:

Option 1: Use an open-source Gen AI model

You can integrate an open-source model, like GPT-2, without paying a subscription fee. But you will be responsible for all the infrastructure costs that can be anywhere between $37,000 and $100,000 for the initial setup, not to mention recurring expenses on electricity, maintenance, etc.

Option 2: Retrain an open-source solution on your data

This opens the possibility for customization and superb performance, but you need to aggregate and clean the training dataset and supply a server that can handle the load. Prepare to spend $80,000-$190,000 on retraining a moderately large model.

Option 3: Deploy a commercially available model as is

You can pay license fees to connect to a close-source model, such as ChatGPT, with your existing software. Some Gen AI vendors charge based on the number of characters in the output text, while others charge per token (a group of characters). The vendor updates and maintains these tools and offers detailed documentation. On the downside, the customization options are limited, and your critical tasks are at the vendor’s mercy.

Option 4: Retrain a commercial model on your data

You can tailor a ready-made model to your business needs by retraining it on your data. Here, you will pay the retraining costs in addition to the vendor’s fees.

Safeguard against bias and malicious performance

After retraining a Gen AI model or deploying a ready-made solution as is, assess the tool for fairness and conduct regular audits to ensure the model’s outcome remains bias-free as it gains access to new datasets. Also, validate if the model can infer protected attributes or commit any other privacy violations.

Test if the model has any harmful capabilities that can be exploited to make it act in adversarial ways.

Encourage collaboration between AI engineers and end users

Encourage AI developers to involve end users in model training and customization. They will give feedback that engineers can use to refine the tool in further iterations. In addition to improving the model, this collaboration will increase AI acceptance in your company.

Prepare the workforce

You will need a team that will help you train and deploy financial generative AI solutions. You can rely on your in-house employees or hire a dedicated team of professionals to support you in this endeavor without having to keep them on the payroll afterwards.

You will also need to train your internal staff, who will work with generative AI-infused processes.

Establish responsible AI framework

You can minimize Gen AI risks by offering detailed guidelines on how to use these tools. For example, PayPal has an AI center of excellence to support employees. The company drafted a responsible AI framework explaining how to use Gen AI tools. For instance, it prohibits employees from uploading sensitive corporate information to open-source generative AI tools.

You can start with the following:

- Set up accountability mechanisms, policies, and ethics, especially when it comes to high-profile applications, such as giving investment advice

- Specify guidelines for employees to follow when using the models in different settings

- Include control mechanisms, such as kill switches, to terminate model involvement in the case of disruptions

- Use a human-in-the-loop approach to ensure the model gives reasonable answers in high-stake situations

- Document the data that was introduced to the model and decide how you manage consent, the right to be forgotten, and other compliance factors

To sum it up

From the real-life examples presented in this article, you can see that generative AI is a valuable tool for the financial sector. And there is more to come.

Mike Mayo, bank analyst at Wells Fargo, said,

The dream state is that every employee will have an AI copilot or AI coworker and that each customer will have the equivalent of an AI agent.

Is it worth implementing generative AI in financial services right now? According to the KPMG survey of US executives, around 60% of the respondents mentioned they would need at least a year to implement their first Gen AI solution. This was back in March 2023. But even if you are not prepared to initiate a large-scale project yet, it’s time to experiment with smaller projects to understand what fits your company best. So, get in touch, and we will be happy to offer our services.

Are you looking to cut costs while improving employee productivity and customer experience? Drop us a line! We will be happy to assist you in finding the right model, retraining it, and integrating Gen AI into your daily operations.

The post How Generative AI in Finance Cuts Costs and Improves Customer Experience appeared first on Datafloq.